This article is about Tata Steel taking over Corus of the UK. This makes the Tata Group company the 5th largest steel producer in the world. Several analysts are pondering over the need for such a takeover. Possibilities include to guard against future hostile bids, acheive scale, entry into the European market and so on.

From various sources including DNA ,Economic Times and Zee News

In the biggest foreign takeover by an Indian company, Tata Steel and Corus Group on Friday reached an agreement on the acquisition of the European steel giant by the Indian firm for 4.3 billion pounds (Rs 36,500 crore).

The board of directors of both the companies approved the acquisition of Corus at a price of 455 pence per share in cash, paving the way for creating the world`s fifth largest steel entity with a capacity of 23.5 million tonnes per year.

"Corus directors consider the terms of the acquisition to be fair and reasonable, so far as shareholders are concerned. The directors intend to unanimously recommend that Corus shareholders vote in favour of the scheme," a joint statement released by Tata Steel and Corus said.

The acquisition will be made by Tata Steel UK, a wholly-owned indirect subsidiary of Tata Steel. The Indian firm has also been able to satisfactorily address the concerns of Corus` two main pension funds.

"This proposed acquisition represents a defining moment for Tata Steel and is entirely consistent with our strategy of growth through international expansion," Tata Group chief Ratan Tata said.

"We have compatible cultures of commitment to stakeholders and complimentary strengths in technology, efficiency, product mix and geographical spread," he said.

Corus Chairman Jim Leng said the combination with Tata represented "the right partner at the right time at the right price and on the right terms.

"This creates a well balanced company, strategically well placed to compete in an increasingly competitive global environment," Leng said.

The Tata-Corus deal comes close on the heels of the acquisition of Luxembourg-based Arcelor by Rotterdam-based Mittal Steel, owned by India-born industrialist L N Mittal. Arcelor-Mittal is now the world`s largest steel company with a combined output of about 110 million tonnes per year.

"The combined entity would be better equipped to remain at the leading edge of the fast changing steel industry," Ratan Tata said.

Leng said the deal with Tata followed talks with a number of Brazilian and Russian companies over the past one year.

The price of 455 pence per Corus shares is a premium of 26.2 per cent to the average closing price of 360.5 pence per Corus share for the twelve months period ended October 4, when the two sides first confirmed of the negotiations.

Tata Steel would fund the deal through its own cash resources and loans. The company is likely to raise about 1.8 billion pounds on its own and would get a loan of about 3.3 billion pounds from Deutche Bank, ABN Amro and credit issue.

As per the deal, at least 75 per cent Corus shareholders must tender their shares for Tata Steel to complete the transaction. The Indian firm has also been able to address the concerns of Corus` two pension schemes - the Corus Engineering Steels pension scheme and British Steel pension scheme - by increasing its contribution rate and paying additional funds.

Corus is Europe`s second largest steel producer, after Arcelor-Mittal, with revenues of 9.2 billion pounds in 2005 and steel output of 18.2 million tons in UK and Netherlands.

Tata Steel is India`s largest private sector steel firm with revenues of 5.0 billion dollars in 2005-06 and steel production of 5.3 million tonnes across India and South-East Asia. Tata Sons, Tata Steel and other Tata firms had combined revenues of about 22 billion dollars in 2005-06.

Tata Steel shares up 4%

Tata Steel stocks surged across the board on the bourses on Friday, on massive buying by funds and investors triggered by reports that Anglo-Dutch steelmaker Corus has accepted the company`s 4.3 billion pounds (Rs 36,500 crores) takeover bid.

Country`s largest steel maker, Tata Steel stocks shot up by Rs 19.30, or about 4 per cent at rs 521 at noon with over 55 lakh shares changing hands on the bourses.

The counter also recorded 112 block deals, placing the benchmark Sensex higher by 88 points at 12,811.59.

Tata Steel to be 40 mt company by 2012

Exuberant over acquisition of Corus, Tata Group said it would make Tata Steel a 32 billion dollar entity by 2011-12 with a combined capacity of 40 million tonnes annually from about 24 million tonnes now.

The acquisition of Anglo-Dutch giant Corus would not affect Tata Steel`s massive ongoing expansion programme in India and abroad, Tata Group Chairman Ratan Tata said after announcing the acquisition agreement.

"While financing the deal, it has been taken care that no plan either in India or expansion in Jamshedpur and overseas expansion will be affected," he said, adding the deal is expected to be completed by the middle of January next year.

Tata Steel has a capacity of 5 million tonnes per year at present, while Corus has a capacity of 18.2 mtpa. The combined entity becomes the world`s fifth largest steel producer.

Elaborating on the financing, company officials said Tata Steel would pump in 3.88 billion dollar through its subsidiary - Tata Steel UK. The balance of about 5.63 billion dollars would be raised as debt from financial institutions including ABN Amro Bank, Deutsche Bank and credit issue.

Under the agreement, Ratan Tata would become Chairman of Corus Group. Jim Leng, who is currently the Chairman, would be the Deputy Chairman of Corus and Tata Steel.

Tata Steel Managing Director B Muthuraman, Tata Sons Director Ishaat Hussain and Arun Gandhi would join Corus board, while the European firm would also have three representatives in the board of Tata Steel.

On the apprehensions raised by credit rating agencies that the deal may affect Tata Steel`s financial risk profile, Tata said, "we believe that the offer we have made is right and at fair value. We believe it is the right offer."

Upbeat over an agreement reached by Tata Steel for acquiring Corus Group in an $8.09 billion deal, the biggest by an Indian company abroad, domestic steel players hailed the takeover as a stamp of authority of Indian entrepreneurs in overseas market.

According to India's largest steel producer Steel Authority of India Limited, the takeover shows the confidence of Indian entrepreneurs.

"It shows the competitive and financial strength of Indian entrepreneurs to go overseas and acquire assets," Sushil Maroo, Director (Finance), Jindal Steel and Power Limited said, similar feelings were echoed by SAIL Chairman SK Roongta who added that it shows the confidence of Indian entrepreneurs in overseas markets.

Consolidation of steel businesses by NRI steel tycoon LN Mittal and now by Tata Group will help the steel industry to tide over fluctuations in the market. "This is good for the sector and also for the country," Maroo added.

Corus Group's Board backed Tata Steel's 455 pence a share bid to takeover the Anglo-Dutch steelmaker. The deal valued at $8.09 billion would make Tata Steel the world's fifth largest steel producer.

Maroo of JSPL said that the Tata-Corus deal would also fire ambitions of many other Indian entrepreneurs.

TATA Steel and Corus may find it difficult to achieve the synergies and cost reductions they are hoping to generate by combining their operations into the world's fifth-biggest entity , analysts warned on Wednesday.

"The strategic rationale is difficult to comprehend ," Merrill Lynch said in a report on Wednesday . "Despite an arguably attractive offer of 455 pence per share, the potential Corus acquisition does not offer cost synergies or a growing market ," the note added.

"While the acquisition can quickly catapult Tata Steel towards global scale, with little immediate benefits visible, we expect concerns on likely dilution , integration issues, longer-term opportunity loss to weigh on the stock price in the near term," brokerage firm CLSA Asia Pacific Markets said.

Tata Steel on Tuesday said that it has made an indicative, non-binding , all-cash bid for Corus at 455 pence per share, valuing the European giant at an enterprise value of about $10bn. A final offer is expected sometime soon.

On Wednesday, Standard & Poor's (S&P ) placed Tata Steel's BBB corporate long-term corporate credit rating on credit watch with negative implications. S&P also placed Tata Steel's BBB foreiogn currency rating on credit watch with negative impications. "In S&P's view, the size of the acquisition and the potential cash outflow of about $10bn that Tata Steel may make in its offer to Corus could have an advser impact on its financial risjk profile," said S&P credit analyst Anshukant Taneja. A successful acquisition, however, can potentially improve the business profile of the merged entity. In resolving the Creditwatch placement, S&P will seek further information on the progress of the offer and the potential means of financing.

Analysts tracking the sector said the "extended timescale for visible benefits" is likely to affect the stock price performance. Tata's main purpose behind the acquisition is to help Corus cut costs by providing it access to cheap raw materials such as iron ore and steel slabs. Corus has little access to iron ore mines and its steel slab-making facilities turn out products that are more expensive than those in developing countries. Tata's acquisition gameplan has been to use its low-cost mines and slab-making facilities to supply to plants near growing markets around the world. According to World Steel Dynamics, Indian steel slab producers have a 22% cost advantage over European companies . While it takes $78 per tonne in India, the cost in Europe is about $100 per tonne.

However, Tata Steel does not have any spare slab-making capacity. It is establishing new capacity of about 1.8mt, but that is completely dedicated to NatSteel of Singapore and Millennium Steel of Thailand. Tata's new slab plant is likely to come up only by about '10 when the 6mt Orissa plant gets commissioned. Till then, analysts say, there will be little benefits. Even if Tata Steel finds a way to export slabs, freight costs from India to Europe are higher than those from Russia to Europe. This means that Tata Steel could be better off setting up a slab-making facility on the fringes of EU than in far away India.

There is also a problem with iron ore. A huge controversy is raging in the country over whether or not to ban exports of iron ore. Several domestic companies, including Tata Steel, have said ore exports should be banned and the mineral should be used to make value-added steel.

The government, analysts say, is unlikely to allow iron ore exports in large quantities. Plus Tata Steel itself would need new iron ore mines which could take about three years or so.

Corus is a high-cost operation and its plants, especially in the UK, are not considered very efficient . Tata Steel may face a difficult choice in dealing with this issue even as a whisper of plant closures or job losses is likely to produce a public outcry.

Corus, at the price of 455 pence per share, is valued higher than Tata Steel, though its earnings performance has been considerably weaker. As of '06-07 , Corus at the takeover price is valued 11.3 times price-to-earnings ratio and 6.5 times at EV/EBITDA per tonne, compared with Tata Steel's 7.4 times PER and 4.2 times.

Since the proposed Tata Steel special purpose vehicle (SPV) is likely to be merged with Tata Steel, that could dilute equity. Tata Steel also, thanks to this acquisition, will have to dilute equity further for raising money for its new expansion plans in Orissa and Jharkhand.

"As Tata will pay significantly high valuation for acquiring Corus and will have to dilute at lower valuation it may result in value destruction for existing shareholders," Mumbai-based Brics Securities said in a report.

Sunday, October 22, 2006

Operation Corus.

Posted by

Arvind

at

3:50 PM

0

comments

![]()

Sunday, June 11, 2006

End of the good times?

Rather Ominous sounding article on the recent stock market corrections et al.

From Rediff columns dated June 10th '06

The change of mood is dramatic. The stock market seeks lower levels every day, and the same people who thought a month ago that a Sensex level of 12,000 was stretched but not unreasonable, now argue that the market will settle at or near 8,000.

Everyone expects interest rates to go up, in part because of the signals from the United States, and the effect will be to cool bank lending - which means slower growth in both consumption and investment.

Then, there is growing concern over the country's trade and current account deficits, especially since oil prices show no signs of softening from their current levels. This, coupled with the pulling out of money by foreign institutional investors, translates into pressure on the rupee - which has already fallen against a soft dollar and could fall further.

And while inflation is still quite low, it will climb now that petrol and diesel prices have been hiked. In short, whether it is the market for stocks, debt or currency, expectations have changed. Added to that are the macro-economic concerns about oil prices, inflation and the trade deficit.

That's not all. It turns out that more than half the companies saw a drop in profits last year (as reported by this newspaper yesterday), a disconcerting fact that was masked by the superb performance of the corporate giants, so the upbeat corporate story doesn't look quite so generalised any more.

As if to underline that point, some sectors are beginning to play to a new tune. The change of mood has already had knock-on effects in real estate (where prices have flattened, if not fallen), and in the public offer of shares, as some companies are postponing plans.

Sitting oddly on this pile of bad news and worse expectations is the evidence of new global confidence in "the India story". IBM's announcement of $6 billion worth of investment in India over the next three years is the headline of the week, on a scale matched only by the Posco steel project in Orissa.

Equally significant is Nissan's announcement that it will get Maruti to do contract manufacture of small cars, mostly for the export market but also for selling to Indian customers - significant, because it confirms that India is becoming a global hub for the production of small cars. And Motorola's announcement that it will start manufacturing mobile handsets in Tamil Nadu adds one more to the list of handset manufacturers who think the Indian telecom market is big enough to locate manufacturing plants here.

It seems that just as the FIIs begin to re-do their maths on India and other emerging markets, FDI inflow is being planned on a matching scale.

The question is whether this is the end of the good times, or whether the India story is still unfolding. Both, perhaps. All the main markets (stocks, real estate, commodities) had begun to see a lot of froth, so some cooling down and condensation is welcome; in fact, this helps a return to sanity and good judgment - and it must be hoped that real estate prices of Rs 50,000 and more per square foot will not be heard of again.

Incremental bank credit had been running ahead of deposit growth for some time, by definition that pace could not have lasted, and so a slowdown in lending was inevitable. In fact, a slowdown in US demand, prompted by higher interest rates, may not be unwelcome if it helps the US address its twin-deficit problem.

As for the economy, the combination of high oil prices, rising trade deficits, tighter money and pressure on the rupee, does mean an over-all loss of tempo. The issue is: how much will things slow down? If the economy can sustain 7 per cent growth for the next year or two (compared to the more than 8 per cent for the past three years) - and there is no reason why it should not - the new mood of near-panic on the market is unwarranted.

If the sober assessment is that this is more in the nature of a correction for the markets, and a step down in gear for the economy, within the same upbeat India story, there is no need for either companies or individuals to change their medium-term assumptions about the future.

Posted by

Arvind

at

11:51 PM

0

comments

![]()

Thursday, March 02, 2006

India's Economic Contrasts

BANGALORE, India, March 1, 2006: From the CBS website

With little more than big ideas and a home computer, Suhas founded his IT services company, Globals Inc, when he was just 14 — and became the world's youngest CEO.

CBS News Chief Foreign correspondent Lara Logan reports on one of the world's youngest and most successful entrepreneurs in part two of a special series India: Land of Contrasts.

It's the kind-of treatment usually reserved for India's Bollywood movie stars, not a 20-year old kid. But when Suhas Gopinath goes back to his old grade school, they let him know he's an inspiration. This local boy has made it big, reports CBS News correspondent Lara Logan.

Gopinath is the boss of a global software company that operates in 11 countries, including the United States. It's a remarkable achievement by any standard — but in India, a developing country saddled with the largest number of the world's poor, it's nothing short of a miracle.

Gopinath's inspiration was none other than Microsoft's Bill Gates.

With little more than big ideas and a home computer, Gopinath founded his IT services company, Globals Inc, when he was just 14 — and became the world's youngest CEO. Six years later, he has even bigger plans.

The new offices for his ever-expanding business in Bangalore are less than a block from the college where he's still studying and the modest house where he still lives with his parents.

Globals employs 600 people — the youngest, a 10-year-old adviser on Web design. Age is no barrier to employment — unless, of course, you're not young enough. The maximum age of his employees is 32.

You wouldn't think that Gopinath's small Indian company could be worth a $100 million to an American firm, but that's exactly how much he says he was offered by a Houston venture capitalist — for just 35 per cent of his business. Gopinath didn't hesitate to turn down the offer.

His story is an astounding example of what's possible in modern-day India's booming economy. However, his story is also the exception. Just 300 miles away, in the slums of India's capital, Delhi, a young man not much older than Gopinath is living a profoundly different existence.

Imagine waking up every morning to comb through mountains of rotting garbage, searching for anything he can sell. It's the only life 24-year-old Bisu Das has ever known.

If he's lucky, he'll make 2,000 rupees a month — that's about $40. Incredibly, that makes him better off than 300 million other Indians — more than the population of the entire United States — who live on less than $1 a day.

No matter what you've heard or read about India's poor, nothing can prepare you for actually seeing it, Logan says. The sight and stench are overwhelming, and there are more flies than you have ever seen in your life. The sheer horror of what poverty really looks like up close is shocking.

Das is one of thousands living in the midst of a massive garbage dump. He told Logan that it's hard not to feel angry. He never thought sifting through garbage would be his life.

So while India rides the economy Gopinath is helping to create, its biggest challenge may be not leaving Das and millions like him behind.

Posted by

Arvind

at

12:56 PM

0

comments

![]()

Friday, February 24, 2006

Bush in India

From the pages of "The Economist"

-----------------------------------------

ON THE 13-hour flight next week from Washington to Delhi, George Bush could do a lot worse than to put aside his briefing books and curl up instead with E.M. Forster's best-known novel. “A Passage to India” is a tale, above all, of misunderstanding: of wrong signals, exaggerated expectations, offence unwittingly caused and taken, and inevitable disappointment. It is a parable of the complications that arise when eager Anglo-Saxons go travelling on the Indian subcontinent.

A degree of wide-eyed enthusiasm on Mr Bush's part is forgivable. India is a rich and exotic prize. Its booming high-tech service sector and tens of millions of affluent consumers have already convinced many of the world's business people that India is on the brink of replicating the astonishing burst of growth that transformed China from poor-house to power-house in little more than two decades. Add in the seductive fact that this “new China” is the world's largest democracy, and the arguments for forging a much closer partnership between India and America seem unassailable.

Rising India

It would not be before time, either. America has neglected India in the past. When Bill Clinton went to Delhi in 2000, his was the first presidential visit for 22 years, and it is surely not a good thing that Mr Bush has waited quite so long to make his own inaugural trip there. India is a nuclear power, home to more Muslims than any country but Indonesia; and it borders China, which many American policymakers see as at best a growing rival and at worst a future enemy. India is seldom regarded in the same way, even though it favoured the Soviet side in the cold war and even though Indian firms offer just as tough competition for parts of America's service sector as Chinese factories do to low-end manufacturing.

Despite all this, there are reasons to urge both sides to tread as carefully as angels before they rush in to an over-enthusiastic partnership. Mr Bush needs to avoid two kinds of mistake. The first, and most serious, would be to shower America's new friend with gifts that the United States can ill afford. Unfortunately, this has already happened. In July, when India's prime minister, Manmohan Singh, visited Washington, he came home with a remarkable present: a promise from Mr Bush that he would aim to share American civilian nuclear technology with India.

That was too generous. Under American and international law, such technology can be given only to countries that have renounced nuclear weapons and joined the Nuclear Non-Proliferation Treaty. India has never joined the treaty, and it tested nuclear weapons in 1998. Mr Bush, in effect, was driving a coach and horses through the treaty in order to suit his own strategic ends, a move that invites the accusation of hypocrisy from other nuclear states and wannabes not so favoured. The idea was that India, in return, should take steps to satisfy the Americans on a long list of nuclear-security concerns, such as not exporting weapons technology and continuing to observe a moratorium on testing. Most important, India was asked to separate its civilian and military nuclear programmes, with the former subject to a rigorous inspection regime.

So far, however, the proposals offered by the Indians actually to do all this are far from adequate. As Mr Bush packs his bags, desperate attempts are being made to bridge the gap. The obvious danger is that in order to portray his summit as a success Mr Bush will be tempted to accept even fewer safeguards from India. That would be a dangerous mistake: nuclear proliferation matters too much to allow excessive wiggle-room or create bad precedents. Fortunately, whatever deal is agreed between Mr Bush and Mr Singh will also require the approval of America's Congress, which has already taken a dim view of Mr Bush's nuclear generosity to India.

Fearful China

Sending the wrong signal on nuclear weapons is not the only potential pitfall in America's romance with India. Mr Bush should also be wary of sending the wrong signal about America's intentions towards China. Too often when Indian-American relations are discussed in Washington, the notion is invoked that India might somehow turn out to be a “counterweight” to China. Yet it is hard to see, in practical terms, what sort of counterweight India could actually be. On the contrary, that sort of talk is liable only to reinforce China's fear that America's grand strategic design is to encircle it and block its rise as a great power. That fear has already been strengthened by America's recent transfer of some of its military might from the Atlantic to the Pacific.

The United States should not base its Asian strategy on that sort of balance-of-power diplomacy. Apart from anything else, India is far too canny, and cares too much about its own China relationship, to be drawn into such a game. Instead of encircling China, Mr Bush should concentrate on putting the American relationship with it on the right footing: deeper engagement, coupled with a determination to make China play by the rules. Yet Mr Bush's approach to this rising superpower has sometimes seemed almost casual: Hu Jintao, China's president, had been made to wait far too long for his state visit to Washington even before Hurricane Katrina forced him to cancel a visit last August. And Mr Bush has not worked hard enough at home to make the free-trade case against the protectionist hawks gunning for China (though, to be fair to him, he has not given them much comfort either).

Mr Bush must also take care to ensure that friendship with India does not damage his close ties to Pakistan, another American ally the president intends to visit on this trip. Pakistan is infinitely more fragile than India, but right now of much greater strategic significance to America. It is central to the fight against the remnants of al-Qaeda and the Taliban in Afghanistan. On top of that, it has an awful record of selling (by unauthorised freelancers, claims its government) nuclear-weapons technology on the open market. Pakistan's president, Pervez Musharraf, has lately shown signs of flexibility towards his country's long and dangerous dispute with India over Kashmir. But both countries need to show flexibility on Kashmir, and Mr Bush must take care not to tilt so far India's way that the Indians feel under no pressure to make concessions of their own. That will merely weaken Mr Musharraf and enfeeble a valuable American ally.

India itself has much to lose if its love-in with America goes wrong. For Mr Singh personally, the stakes are quite high. By backing American efforts to tackle Iran's nuclear ambitions, he has infuriated the left-wing parties on whose support his minority government depends, as well as some of his own party colleagues. If he cannot pull off a decent nuclear deal of his own, he will suffer for it. He is already learning that America's embrace is not the uncomplicated affair he might have hoped for. A visionary Indian project would see gas piped from Iran, via Pakistan. But as relations between America and Iran rapidly deteriorate, America is ever more reluctant to see it go ahead. Meanwhile, India's growing trade with America, whether in textiles or software services, is starting to run into a new generation of Asia-bashers in America. As E.M. Forster knew, no passage to India is ever entirely smooth.

Posted by

Arvind

at

4:01 PM

0

comments

![]()

The Battle for Bangalore...

From the Times in UK!!!

Highlights emerging trends in the emerging software industry in India and the fact that India has become a destination for quality software development: not just cost-cutting outsourcing work.

-------------------------------------------------

India is turning into a battleground for the hearts and minds of software developers. On one side are the forces of opensourcing, ranged against them is Bill Gates's Microsoft. It is a battle neither can afford to lose, writes Gervase Markham..

A nasty catfight has been going on in Washington and the American press. The essence of the battle calls into question the patriotism of CEOs who would sell out their countrymen for a quick buck by taking advantage of offshoring - a word guaranteed to cause an American software engineer to choke on his high-caffeine Jolt.

American companies, being squeezed by low-cost, high-work-ethic competition from Asia, are looking to cut overheads by outsourcing their IT jobs. The destination of much of this exodus is the booming tech sector of India, as the world's second most populous country leverages the widespread knowledge of English, a legacy of its colonial past. The nexus of this growth is Bangalore, which boasts more than 200 technology companies and the highest number of engineering colleges of any city in the world.

And now a different fight has begun in earnest. In terms of the global IT landscape, it is perhaps more significant. It is the battle for the hearts and minds of those tens of thousands of Indian software developers.

On one side is Microsoft, hoping to tempt them with visions of a smoothly-integrated development system from a single vendor. On the other side is the free software movement, talking about the importance of liberty, unrestrictive licensing and control of your own computing environment. At stake is the ability to harness the brainpower of an entire subcontinent of hackers.

In the most recent exchange of fire, Microsoft's shot made the loudest bang. Buoyed by a no doubt sincere but also profile-raising series of visits by Bill Gates to Delhi slums and AIDS counselling centres, there was extensive international coverage of Microsoft's "Ready Launch 2005" event at the Bangalore Palace. There, Gates announced a $1.7 billion investment in India over the next four years, split between "donations" of software to schools, job creation and building, and developer evangelism.

However, reading the reports, one can't help but see a slightly patronising tone in their approach. One announcement which typified this was "Code4Bill" - a recruiting exercise dressed up as a competition, involving a series of online tests and real-world interviews. These whittle down the entrants to a final 20 who win internships at Microsoft India, and maybe even (gasp!) a job. The lucky grand prize winner gets to work in the "Bill Gates Technical Assistants Team" in Redmond for a year.

By contrast, the FOSS.IN (FOSS stands for "free and open source software; .IN is the country code for India) conference, a week beforehand in the very same venue, received comparatively little publicity. There were 2,700 attendees gathered to hear big names in the Linux world such as Alan Cox, the impressively-bearded Welsh kernel hacker, who gave "brutally technical" programming talks. The event's sponsor list reads like a roll call in the ABM ("Anyone But Microsoft") army - Intel, Google, Sun, HP.

At first glance, despite the Microsoft marketing muscle and donated dollars, free software should be a shoo-in. In a country which wants to encourage entrepreneurship and expand its economy, why pay more for less control? However, the free software community has its own, rather unexpected hurdle to overcome - a cultural one. Despite India being "the world's largest consumer of free software", not much code is making its way back to the major projects. It seems that Indian developers often have a difficult time engaging with the community.

There have been several reasons suggested for this. One is that the Indian university system is more oriented to creating large numbers of employable graduates who pass tests, assembly-line style, than encouraging creativity and risk-taking. In a country where an engineering degree is the ticket to a reasonably comfortable life, no one wants to rock the boat. Another factor is that Indian developers are often most comfortable with a structured work plan and clearly-defined boundaries. This style of working is not a good fit for the self-motivated, somewhat chaotic style of the free software bazaar.

So at the moment, the scales are evenly balanced. India is there for the taking. In five years' time, will India be Coding 4 Bill, or Coding 2 Share?

Gervase Markham works for the Mozilla Foundation, a non-profit organisation dedicated to promoting choice and innovation on the internet. His blog is Hacking for Christ

Posted by

Arvind

at

12:01 AM

0

comments

![]()

Monday, February 06, 2006

SAP finds Indian techies too costly.

From the Times of India

SAP, the world’s third-biggest software company, is cutting its recruitment of Indian experts because they are too expensive and is instead looking towards China, its CEO Henning Kagermann said in an interview.

With Indians pricing themselves out of the market, SAP preferred to recruit in China and low-cost eastern European nations. “India is getting too dear,” said SAP CEO Henning Kagermann in the interview with the Financial Times published on Monday.

“We’ve decided to only recruit a certain number more from there, and then to start looking around in other locations,” he added.

The Indian software industry, particularly companies based in Bangalore and other high-tech centres, has attracted huge interest over the past decade from international investors seeking sophisticated skills at low salaries.

---------------------------------------------

Addendum : Its to be noted that an entry level software programmer in India still commands just around $5000, compared to the $50000 for an American programmer.

However this rate is growing at an estimated 11-15% a year.Perhaps its higher.

Further, SAP itself is still hiring in India, albeit at a claimed "slower" rate.

Microsoft plans to double capacity at its Hyderabad center

Google has just set up shop in Bangalore

Cisco plans to inaugurate its swanky new campus in Bangalore.

IBM, CSC and other giants also have grand plas for their Indian operations.

However our real threat remain other low cost offshoring locations like China, Thailand, Malaysia etc

Posted by

Arvind

at

7:03 PM

0

comments

![]()

Finally...Sensex makes history, touches Peak 10000

from Indiatimes Dated: 6th February.

The Sensex finally breached the coveted 10,000-point mark driven by robust buying interest across a host of index scrips.

The historic run on the bourses was accompanied by gains in all the 30 Sensex scrips. The 30-share benchmark index scaled a life-time high of 10,002.83, registering a gain of more than 250 points, over Friday's close of 9,742.58.

ICICI Bank was leading the pack of gainers on the Sensex with a gain of more than 6%. Pharma major Ranbaxy also jumped more than 5%, while gaining on the back of an overseas joint venture formed by the company.Among the other gainers, ONGC, Reliance Industries (RIL), L&T, HDFC, Hindalco, Cipla, TCS and Bajaj Auto also registered gains of more than 2%.

The NSE Nifty also jumped past the 3,000-point mark and scaled an intraday high of 3,009.45, which was barely 2 points below the life-time high of 3,011.05.

The market indices soon gathered momentum after opening on a cautious note. The BSE Sensex opened 3.51 points up at 9,746.09, while the NSE Nifty opened 0.35 points up at 2,940.95.

Buying interest was conspicuous across a host of sectors including auto, banking, software, engineering and FMCG sectors.The record-breaking rally materialised with any major broad-based catalysts, with the Q3 earnings season coming to an end and the mixed trends witnessed in the global markets on Friday/Monday.

The benchmark ended the previous week at 9,742.58, after scaling a life-time closing high of 9,919.89 on Tuesday, January 31, 2006. The 30-share benchmark index missed the elusive 10,000-point mark by barely six points in intraday trade last week.

The market observers expect the continuing strength in FII inflows and robust liquidity position of the domestic mutual funds to continue to provide support to the market sentiments.

The market sentiments are also likely to gain support from the pre-budget expectations in the near term. Traditionally, markets witness a pre-budget rally in the run-up to the union budget on expectations for possible government sops for India Inc to boost the country's economic growth.

Posted by

Arvind

at

5:32 PM

0

comments

![]()

Thursday, February 02, 2006

India to launch rural job scheme.

This is the "Employment guarantee scheme" which was promised by the UPA when it came to power, last year.Could turn out to be a major white elephant, which is expensive and poorly implemented. Also it will divert funds from healthcare , education and infrastructure.

Overall this scheme is a temporary Band-aid rather than an effective surgery to solve our country's chronic unemployment. The infrastructure envisioned to be built - roads, irrigation whatever, is bound to be of poor quality and haphazard.

And given our country's dismal implementation record, lets see how far this goes.

------------------------------------------------

From the BBCWorldwide Website:

The scheme will target India's 60m rural households

The Indian government is due to launch one of its most ambitious efforts to eradicate rural poverty.

Under the National Rural Guarantee Scheme one member from each of India's 60 million rural households is guaranteed 100 days of work each year.

They will receive a minimum wage of 60 rupees ($1.50) and if that does not work, an unemployment allowance.More than a third of India's population of more than one billion people lives on less than a dollar a day.

The first phase of the programme will cover 200 of the country's poorest and least developed districts.

Prime Minister Manmohan Singh will launch the scheme in a village in the drought-prone Anantapur district of southern Andhra Pradesh state.

The president of the governing Congress Party, Sonia Gandhi, will also be present on the occasion.

The Congress Party swept to power in 2004 after it pledged to improve the conditions of India's poor.

Critics

The programme will be extended to the entire country over the next four years and is being seen as an important effort to curb the migration of villagers to India's overcrowded cities.

The Congress campaign used the scheme in election campaigns

Analysts say this is the most ambitious pro-poor scheme launched by an Indian government, in a country where nearly 70% of the population lives in villages.

People employed by the scheme will work on projects such as building roads, improving rural infrastructure, constructing canals or working on water conservation schemes.

The government says special priority will be given to women.

However, critics say the scheme is too expensive and question whether the government will be able to support it.

They say rather than paying for unskilled manual labour, the government should invest in improving rural infrastructure - especially in health care and education.

Others say there is little transparency, which may lead to red tape and corruption.

Posted by

Arvind

at

2:07 PM

0

comments

![]()

Saturday, January 28, 2006

India to become the world's 3rd largest economy by 2015

This article is from HT

The heading obviously only holds in PPP terms. In absolute $ terms , we do have a long way to go yet.

Check the projections for 2050 and see where the US,China and India stand. A bit scary this.

Anyways it remains to be seen how this shift in the balance of economic power will impact the rest of the world.

-----------------------------------------------

India is slated to become the third largest economy with a share of 14.3 per cent of global economy by 2015 and graduate to become the "third pole" and growth driver by 2035.

"As the share of USA in World GDP falls from 21 to 18 per cent and that of India rises from 6 to 11 per cent in 2025, the latter emerges as third pole in the global economy," economist Arvind Virmani said in an article published in ADB India Economic Bulletin.

India, which is now the fourth largest economy in terms of purchasing power parity, will overtake Japan and become third major economic power within 10 years.

India will increase its share from 8.2 in 2015 to 11.2 per cent of world GDP by 2025, and is projected to be about 60 per cent of the size of US economy.

"The transformation into tri-polar economy will be completed by 2035 with Indian economy only a little smaller than US economy but larger than that of Western Europe," Virmani, a director of economic think-tank ICRIER, said.

By 2035, India is likely to be a larger growth driver than the 6 largest countries in EU, though its impact will be a little over half that of the US.

India's share of global economy would be 14.3 per cent, while China will dominate with 30 per cent and USA at second place with 16 per cent by 2035.

China's economy is projected to become 50 per cent larger than US economy by 2025 and almost double that of USA by 2035, he said.

At this point China's share of the world economy will be equal to the share of the US and Indian economies taken together, he said.

Posted by

Arvind

at

7:45 AM

0

comments

![]()

Friday, January 13, 2006

India's Promise...

Awesome article on why India is still developing ....and not developed. Found on the web here

---------------------------------------------------------------------------------------------

At the beginning of the great European explorations of the world, India was home to a fabulous amount of wealth. Indeed, all the invading empires from the Mughals to the British became vastly rich. And the Maharajahs and Nawabs in the Princely States that were scattered throughout India accumulated enormous wealth over many centuries.

The end of British colonialism left Indians with some amazing opportunities and daunting challenges. Few countries have started with so much promise.

Those that became leaders of the world’s largest democracy were given a modern physical infrastructure that included one of the best railway systems in the world. And they were in possession of a well-developed “institutional” infrastructure that provided the possibilities of gaining from the advantages associated with the rule of law.

But the new rulers in New Delhi that took over from the British soon began to squander the birthright of their own citizens. Much of India’s population suffers from dire poverty, caused by serial blunders in economic policy.

In a classic case of deflecting blame for their own shortcomings, many politicians insist that the size of the population is India’s biggest problem. It is hard to imagine a more cynical or despicable lie. If left free from the extensive interferences of various levels of government, the energy and creativity of the Indian people would soon allow them to be among the richest on earth.

Indians are not poor because there are too many people. Instead, many Indians are poor because of regulations that interfere with the creation of new businesses and jobs.

India was ranked 116th in a report by the World Bank (“Doing Business”) that evaluates the ease of doing business in 155 countries. The rankings examine the time, cost and minimum capital requirement to start a business as well as the difficulty of hiring and firing workers. Also examined are barriers for obtaining licenses and registering property as well as access to credit and protection for investors.

India’s political culture is guided by socialist instincts that reflect the beliefs of its modern founders. In a preamble to the Indian Constitution modified by Indira Gandhi during the Emergency of the 1970s, India is identified as a “sovereign, secular, socialist republic”.

At the same time, an amended section in the Representation of Peoples Act required that all recognized and registered parties must swear by this Preamble. All parties must in theory stand for socialism. There are no parties that espouse classical liberalism, even while there are many communist parties.

There is difficulty in abandoning ideas with such honored lineage, but socialism has been widely discredited and abandoned so Indians should reconsider this commitment. Perhaps local disasters arising from India’s socialist state provide better reasons to give up on it.

Public policy guided by socialism promotes division, social instability and economic destruction. Socialism ignored the fact that poverty arises from low economic growth and insufficient capital formation. As indicated by its rank of 66 out of 127 countries in the Economic Freedom of the World report released by the Cato Institute (2005), India has too many policies that hinder private investments.

In the past, it was suggested that India experienced an unavoidably slow “Hindu rate of growth” based upon its dominant cultural heritage. Instead, socialism and interventionist policies caused slow economic growth in the past and imposed the greatest harm on the poor and unskilled that lost access to economic opportunities.

The Capital Access Index (CAI), constructed by the Milken Institute, evaluates the quality of domestic capital markets. The Index follows the premise that access to financial markets is the key to long-term growth and to reducing poverty and income gaps. India ranks 53rd out of 121 countries surveyed.

At issue is nothing less than India’s future. Should the Indian state be a vehicle for groups to gain power who use it to further their own narrow ends? This approach seems likely to weaken and perhaps invite the destruction of India’s democracy.

Or should the Indian state of the future be a mechanism to protect the freedoms and rights of individuals living under a general law with shared allegiance to a secular state? If so, there is a better chance that India’s democracy will survive and more of its people can prosper.

Posted by

Arvind

at

9:55 PM

0

comments

![]()

Tuesday, January 10, 2006

India 'Loses 10m Female Births'

From the "BBC" magazine article linked here

More than 10m female births in India may have been lost to abortion and sex selection in the past 20 years, according to medical research.

Researchers in India and Canada for the Lancet journal said prenatal selection and selective abortion was causing the loss of 500,000 girls a year.

Their research was based on a national survey of 1.1m households in 1998.

The researchers said the "girl deficit" was more common among educated women but did not vary according to religion.

The unusual gender balance in India has been known about for some time.

In most countries, women slightly outnumber men, but separate research for the year 2001 showed that for every 1,000 male babies born in India, there were just 933 girls.

Ultrasound

The latest research is by Prabhat Jha of St Michael's Hospital at the University of Toronto, Canada, and Rajesh Kumar of the Postgraduate Institute of Medical Research in Chandigarh, India.

They found that there was an increasing tendency to select boys when previous children had been girls.

The sex ratio is so skewed in some states, men cannot find brides |

In cases where the preceding child was a girl, the ratio of girls to boys in the next birth was 759 to 1,000.

This fell even further when the two preceding children were both girls. Then the ratio for the third child born was just 719 girls to 1,000 boys.

However, for a child following the birth of a male child, the gender ratio was roughly equal.

Prabhat Jha said conservative estimates in the research suggested half a million girls were being lost each year.

"If this practice has been common for most of the past two decades since access to ultrasound became widespread, then a figure of 10m missing female births would not be unreasonable."

'Shameful'

Sex selective abortions have been banned in India for more than a decade.

![]() This just means that girls will be far more sought after in future

This just means that girls will be far more sought after in future ![]()

![]()

Experts in India say female foeticide is mostly linked to socio-economic factors.

It is an idea that many say carries over from the time India was a predominantly agrarian society where boys were considered an extra pair of hands on the farm.

The girl child has traditionally been considered inferior and a liability - a bride's dowry can cripple a poor family financially.

The BBC's Jill McGivering says the problem is complicated by advances in technology. Ultrasound machines must be officially registered but many are now so light and portable, they are hard to monitor.

Although doctors in India must not tell couples the sex of a foetus, in practice, some just use coded signals instead, our correspondent says.

Last year the well-known religious leader and social activist, Swami Agnivesh, began a campaign across five northern and western states against female foeticide."There's no other form of violence that's more painful, more abhorrent, more shameful," he said.

Posted by

Arvind

at

2:53 AM

0

comments

![]()

Sunday, January 01, 2006

MILLIONAIRES On the street

MILLIONAIRES On the street :from The Times of India

A hawker who owns cars, a beggar who owns three houses, a sweeper who runs a company. In Indian cities there are happy endings

Then: Chaatwala

Now: Chaatwala with a Mercedes

Tucked away in a tiny bylane near UPSC in Delhi are a group of "Coco-Cola" umbrellas that are usually swarmed by hordes who are relishing the transitory joys of junk food. Brothers Jagdish and Gopal Das, along with two other brothers, run this roadside shop that comedian Mehmood used to frequent once. “We manage to earn enough to go home and eat one square meal,” says Gopal Dayal vainly trying to achieve modesty. When he is reminded that his family owns a Mercedes, Gopal mumbles, “ Hamare pitaji ke paas Mercedes hai, par woh to ab purani baat hai. (My father has a Mercedes but that’s an old story).”

Despite the success of the shop, the brothers lived under the constant fear of being uprooted by the municipality. “MCD has allotted us land near the garbage dump not far from here. Business dropped, so we came back,” says Gopal.

Then: Beggar

Now: Beggar who has investments

Sambhaji Kale has Rs 40,000 hard cash in the bank, a few thousands in investments, a flat in Mumbai suburb, Virar, two houses and a plot in Solapur. Kale, his wife and their four children beg at traffic signals. They make about Rs 1,000 a day but live in some wooden boxes near the Khar signal. Their Virar flat has been let out, chiefly because commuting from Virar to Mumbai’s nerve centres would have added to their expense.

The Kales enjoy a fair bit of adulation among their ilk. Everyone knows them well, even the postman who never fails to bring them letters and other correspondence from the bank to their wooden boxes on the wayside.

Then: Peon

Now: Peon who drives

It’s not clear how many cars the Municipal Commissioner of Mumbai is entitled to but one of his peons has three. Rajesh Naik, 29, came to Mumbai from Sindhudurg five years ago. Now he owns two Tata Indicas and a second-hand Sumo. He had procured the vehicles on loan with the intention of hiring them out. He gets more than fifteen bookings per month and every booking fetches him about Rs 5,000, probably more than his pay. He has already paid off the loan of one of the Indicas, and hopes to pay the other by this year-end.

It’s hard to understand why he does not quit his peon job. “I will never leave it because it gives me respect and security.”

Then: Parking attendants

Now: Crorepatis

This story may not have the poignancy of urban toil but it still shows how Indian cities can make dreams come true. Six months ago, Patel brothers Vinubhai, 51, Girish, 45, and Chandrakant, 43, handed out parking tickets and sold paan outside a multiplex in Ahmedabad. Then one fine day, the sweeping multiplex culture suddenly took them to unexpected wealth. Their ancestral land on the Sarkhej-Gandhinagar Highway, that used to be worth nothing much, sold for Rs 60 crore.

Now the brothers are waiting for their chartered accountant to help them make investments, and “help us avoid taxes”.

Then: Sweeper

Now: Owner of a housekeeping company

Bhagiram Tank likes to call himself “zero”. That was what he was in 1965 when he left Ghaziabad as a 15-year-old. His father was a cleaner at the Radio Club in Mumbai and Bhagiram replaced him. He cleaned bathrooms, kitchens, the swimming pool and the wedding hall.

Very soon he branched out to providing organised cleaning services as a smalltime contractor. Today, 30 big corporate houses including Pepsi, Modicare, Raymond, Essar, Procter & Gamble, Lupin and Chemtex are his clients. Tank now employs around 800 people at his Unique Housekeeping, and has diversified into the security business with a former army commando. He owns a two-bedroom flat in Kandivli and drives a Tata Sumo. “I never lost sight of my responsibilities. The only fantasy I had was to undergo plastic surgery and look handsome, but my doctor talked me out of it,” he says, laughing.

Then: Vada Pav hawker

Now: Earns Rs 3 lakh per month

“I am busy now, Come on Saturday,” Ashok Manohar Satam says blandly, when asked for an interview. On any weekday, from 9.30 in the morning till 9.30 in the night, Satam has no time for conversation. He is busy doing brisk business at his vada pav stall near the Central Telegraph Office opposite Flora Fountain in Mumbai.

Thirty five years ago, Satam and his three brothers helped their postman father who ran the stall only in the evenings. The vada pav cost 50 paise then and they managed to sell about 150 a day. Now, Satam sells about 2,000 vada pavs a day at Rs 5 a piece. Satam’s business has been growing at 10% per annum since the last few years. “Mumbai has a lot of prosperity now. More crowds, more people, more wealth,” he says.

Once his family of eight used to live in a one-room tenement, the kind of place from where most of Mumbai emerges for air. Now his family has moved into four flats, all in the same building. His 22-year-old son is studying hotel management, and a younger son is pursuing a science degree in Ruparel College.

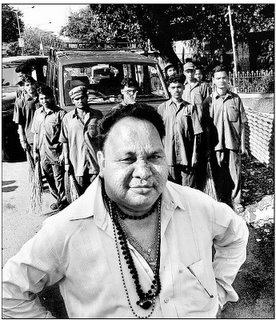

CLEAN SWEEPER

BHAGIRAM TANK

USED TO BE A SWEEPER. NOW HE RUNS A HOUSE CLEANING AGENCY AND DRIVES A TATA SUMO. ONLY ONE WISH REMAINS UNFULFILLED. “I WANTED TO UNDERGO A PLASTIC SURGERY AND LOOK HANDSOME. BUT MY DOCTOR TALKED ME OUT OF IT.”

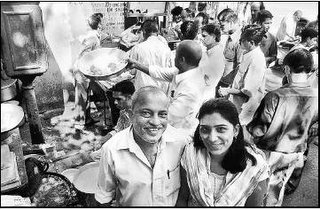

BREAD AND BUTTER

ASHOK SATAM

MAKES RS 3 LAKH A MONTH SELLING VADA PAV AT FLORA FOUNTAIN. ANOTHER VADA PAVWALA IN MATUNGA OWNS A HYUNDAI ACCENT AND HIS CHILDREN GO TO AN ENGLISHMEDIUM RESIDENTIAL SCHOOL

THE BETELS MUCHHAD PAANWALA PREMSHANKAR TIWARI

2 HOUSES 2 ALSATIANS 1 WATCHMAN 1 WEBSITE “MANY CARS” THAT’S WHAT THE BROTHERS FROM U.P. OWN AFTER SELLING PAANS IN MUMBAI

Posted by

Arvind

at

2:44 PM

1 comments

![]()